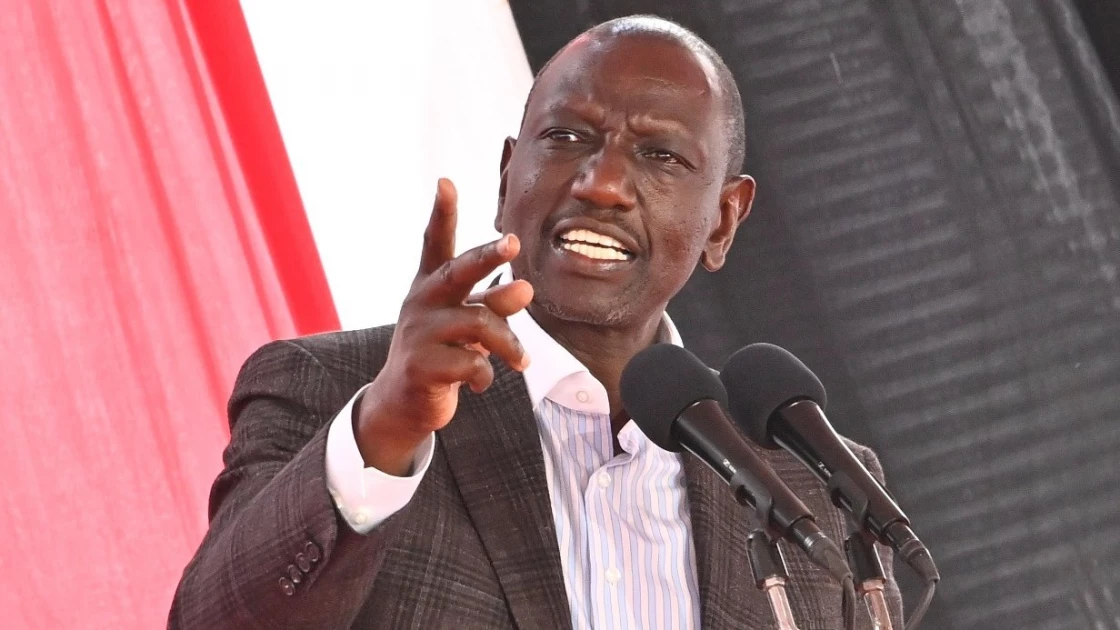

President William Ruto has defended the Housing Levy amidst opposition from employed Kenyans, who are the main target of the taxation.

Speaking during the Salvation Army’s 100th-anniversary celebration at Ulinzi Sports Complex in Nairobi, Ruto said the programme is aimed at providing jobs as well as decent housing for Kenyans who do not have housing.

“We have many Kenyans living in slums and it is our responsibility, for those with a job to contribute to the Levy to provide shelter for those who don’t have,” Ruto said.

“We want to have a program that will employ young people through housing, export of labour, digital jobs and manufacturing so that our young people do not remain jobless after graduating from universities.”

Several Kenyans have been opposing the levy, terming it burdensome and oppressive since only formally employed Kenyans are targeted.

Recently, Attorney-General Justin Muturi cautioned the Kenya Revenue Authority (KRA) against making any collections from levy declared illegal by the Court of Appeal on January 26, 2024.

“The upshot of this is that there is no legal basis on which the housing levy as provided in section 84 of the Finance Act can be implemented,” the AG told the taxman in a letter dated February 21, 2024.

“Therefore, our considered opinion is that as of the date of delivery of the ruling of the Court of Appeal on January 26, 2024, there is no legal provision that enables the collection and administration of the Housing Levy.”

Court rules on Housing Levy

This comes days after the High Court and the Court of Appeal ruled that the Housing Levy was introduced without a legal framework.

“It also held that the levy was targeting a section of Kenyans. In our view, public interest lies in awaiting the determination of the appeal. This is because if the stay sought is granted at this stage, should the appellate court affirm the impugned decision, then some far-reaching decisions that will have been undertaken pursuant to the impugned laws may not be reversible,” the appellant judges stated.

“Public interest in our view tilts favour in not granting the stay or the suspension sought. Public interest tilts in favour awaiting the determination of the issues raised in the intended appeals. We find and hold that none of the 4 consolidated applications satisfies both limps. Accordingly, civil applications Nos. E577 of 2023, E581 of 2023, E585 of 2023 and E596 of 2023 are hereby dismissed.”

The Housing Levy and several other sections of the Finance Act were declared unconstitutional by a three-judge bench made of Justices David Majanja, Christine Meoli, and Lawrence Mugambi on November 28, 2023.

According to the three-judge bench, the Housing Levy contravened the Constitution given that only employed Kenyans faced deductions.

In January, the Court of Appeal upheld the High Court’s decision that the Housing Levy was unconstitutional.

After the appellant court’s ruling, the Speaker of the National Assembly Moses Wetang’ula vowed to move to the Supreme Court to overturn the ruling.

Wetang’ula said he will plead with the top court to quash the decision by a three-judge bench of the appellate court that barred the National Treasury’s plan and Kenya Revenue Authority from further compelling workers to contribute 1.5 per cent of their salary towards the Housing Levy.

Wetang’ula said he intends to appeal the ruling rendered by Court of Appeal Judges Lydia Achode, John Mativo and Mwaniki Gachoka whose verdict he is dissatisfied with.

“The Speaker of the National Assembly and the National Assembly being dissatisfied with the entire ruling of the Court of Appeal judges, given at Nairobi on January 26, 2024, intend to appeal to the Supreme Court against the whole ruling,” the notice to appeal reads.

Wetang’ula wants the Supreme Court to intervene and suspend the High Court Judgement and allow the Housing Levy deductions to continue pending the hearing of his appeal at the Court of Appeal.